In our weekly regulatory roundup we give a brief overview of the most recent regulatory news and developments in the financial services sector. Courtesy of our partner firm, RegAlytics.ai.

Regulator of the Week: Federal Reserve

The Regulator of the Week is the Federal Reserve.

For those who read the federal register every week, there are always about a dozen “data collection” alerts. This week, the Federal Reserve is celebrating the 104th anniversary of its very first data collection, which was weekly information about bank balance sheets. It was started in response to World War I when the Federal Government was issuing a lot of war bonds, and decided they needed to carefully monitor the health of the economy through this data.

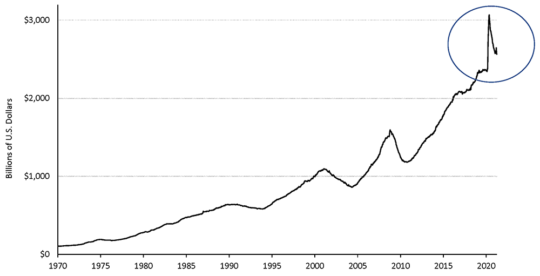

Below is a chart of outstanding bank loans since 1917.

Figure 1. Banks’ Weekly Commercial and Industrial (C&I) Loans Outstanding, January 1970 ‐ March 2021

Source: H.8 statistical release, Federal Reserve Board (https://www.federalreserve.gov/releases/h8/).

TOPIC OF THE WEEK

Elder Abuse Awareness

June 15th is the official date for World Elder Abuse Awareness Day. The level of fraud and the regulatory response to it has been elevated significantly before the pandemic but especially during the pandemic. Lots of states have included acute damages when someone is found to commit fraud directed at senior citizens.

DOJ: Data Companies Fined for Selling Elder Data

This week, the DOJ nailed two data companies for knowingly selling market data about elder victims to scammers. The first company is paying $42M, with $33M going back to victims and the second company is paying $150M, with $127.5M going back to victims.

CA AG: Grave Robbers

California caught and sentenced former Fresno County employees for their roles in a multi-year embezzlement conspiracy that included stealing more than $300,000 from the estates of deceased individuals. The defendants in this case were held accountable for their actions because of an investigation by the Fresno County District Attorney’s Office as well as the California Department of Justice’s Special Investigation Team (SIT) and Fraud and Special Prosecutions (FSP) Section.

CLIMATE

CME: Nature-Based Global Emissions Offset Futures

CME Group announced the launch of a Nature-Based Global Emissions Offset (N-GEO) futures contract in August, pending regulatory reviews.

BoE: Climate Disclosure Report

The Bank of England published its second annual climate disclosure report to set out its approach to managing risks from climate change across its own operations. The disclosure report covers the Bank’s climate change strategy, the governance structures and processes around its climate-related work, and the measurement and management of climate-related risks across its physical and financial operations.

CRYPTO

Box Exchange: Boston Securities Token Exchange

Box Exchange has been working on launching the first fully registered securities token exchange. This week, the SEC opened up another comment period for the latest iteration of how this will work, which marks progress.

FCA: Cryptoassets Market Research

Published this week by the Financial Conduct Authority in the UK, a report on cryptoasset ownership estimates that 2.3 million adults now hold cryptoassets (which is up from 1.9 million last year). 38% of crypto users regard them as a gamble (which is actually down from 47% last year), while increasing numbers view them as either a complement or alternative to mainstream investments.

DIVERSITY & INCLUSION

FINRA: Board Diversity

FINRA put out a statement on building board diversity. Marcia Asquith, Executive Vice President of Board & External Relations, and Jennifer Piorko Mitchell, Vice President of Corporate Governance and Deputy Corporate Secretary, discuss how FINRA has prioritized diversity in the boardroom.

OCC: Bias in Real Estate Appraisals

The OCC made a statement about reducing bias in real estate appraisals. Acting Comptroller of the Currency Michael J. Hsu highlighted the significant impact bias in appraisals has on minority families and how it contributes to a greater wealth gap between minority and majority populations.

SEC: ESG & Diversity and Inclusion

The SEC’s Asset Management Committee announced a meeting on July 7th. The meeting will include a discussion of matters in the asset management industry relating to: (1) the ESG, Diversity & Inclusion, and Private Investments Subcommittees, including potential recommendations from those Subcommittees; and (2) the Evolution of Advice Subcommittee, including a panel discussion.

NY AG: Anti-Jewish Housing Discrimination

The New York Attorney General announced agreements with Orange County and the Town of Chester to end their use of discriminatory housing practices that were designed to prevent members of the Jewish community from moving there.

We’ll be updating the blog weekly with regulatory updates. Stay connected to learn more.